Pakistan’s security calculus is undergoing a subtle but important expansion. Traditionally defined through territorial defence and counterterrorism, national security is now increasingly tied to economic resilience, investor confidence, and technological integration. The recent meeting between Chief of Defence Forces and Chief of Army Staff Field Marshal Asim Munir and a high-level US fintech delegation reflects this broader recalibration.

According to official accounts, the delegation from World Liberty Financial, led by its chief executive Zachary Witkoff, discussed financial inclusion and cross-border digital financial systems with Pakistan’s top military leadership. The engagement itself is telling. International private investment groups do not seek out symbolic meetings. They respond to signals of stability, continuity, and institutional coherence.

Pakistan’s economic security challenge is not abstract. Weak financial inclusion, informal capital flows, and limited access to secure digital systems create vulnerabilities that extend beyond markets into governance and law enforcement. Illicit financing, terror funding, and unregulated money movement thrive where systems are fragmented. Strengthening digital financial infrastructure therefore directly intersects with counterterrorism objectives.

Economic security as counterterrorism infrastructure

Field Marshal Asim Munir’s emphasis on economic stability and investor confidence reflects an understanding that modern security threats are hybrid in nature. Militancy feeds on economic despair, weak institutions, and governance gaps. A secure, transparent, and inclusive financial system narrows the space in which extremist networks operate, recruit, and finance themselves.

Pakistan’s experience with terrorism has repeatedly shown that military action alone is insufficient. Sustainable gains require administrative capacity, economic opportunity, and state presence in everyday life. Financial inclusion, especially in underbanked and conflict-affected regions, strengthens that presence by integrating citizens into formal systems rather than leaving them exposed to parallel economies often exploited by militant groups.

This context gives added weight to the ISPR’s emphasis on creating a conducive environment for responsible private sector participation. Responsible capital, unlike speculative inflows, tends to demand rule-based systems, compliance, and predictability, all of which reinforce state authority.

Regional competition for capital and credibility

The meeting also needs to be read against a regional backdrop. South and Central Asia are competing aggressively for fintech investment, digital payment ecosystems, and cross-border financial platforms. Countries that offer regulatory clarity, security assurance, and institutional alignment attract capital. Those that do not are bypassed.

Pakistan’s outreach to global fintech leaders signals an attempt to reposition itself within this competitive landscape. Field Marshal Asim Munir’s role in this engagement matters. In Pakistan’s context, investor confidence is inseparable from perceptions of security stability. The presence of the military leadership reassures external actors that economic initiatives are backed by institutional continuity rather than transient political cycles.

This is particularly relevant as neighboring regions grapple with instability, sanctions, and governance breakdowns. Afghanistan’s financial collapse and isolation stand as a cautionary example of what happens when economic systems are severed from global networks. Pakistan’s approach appears to be moving in the opposite direction, towards integration rather than isolation.

Security challenges running in parallel

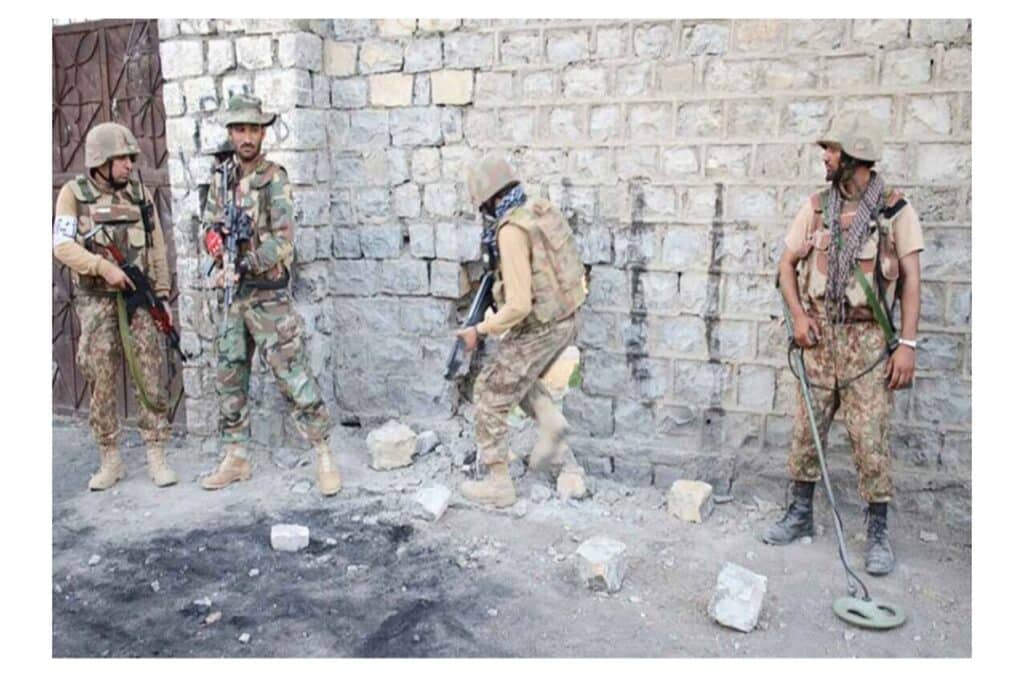

This economic outreach, however, is unfolding alongside persistent security threats. Terrorism has not disappeared, and hostile networks continue to test the state’s capacity, particularly in border regions. That is precisely why economic stability is being treated as a security multiplier rather than a separate policy domain.

Field Marshal Asim Munir’s engagement with international economic actors should be seen as part of a broader strategy that links internal security, counterterrorism, and economic governance into a single framework. The objective is not growth for its own sake, but resilience, the ability of the state to absorb shocks without ceding space to violent or criminal actors.

In this sense, fintech, digital payments, and financial inclusion are no longer just development tools. They are instruments of statecraft.

Pakistan’s recalibration is quiet, but deliberate. By aligning economic outreach with security leadership, the state is signaling that the fight against terrorism is no longer confined to battlefields and intelligence operations. It is also being fought in balance sheets, payment systems, and the everyday economic lives of citizens.

That shift, if sustained, may prove as consequential as any kinetic operation.